A Federal High Court sitting in Lagos has directed the Central Bank of Nigeria (CBN) and the Economic and Financial Crimes Commission (EFCC) to conduct separate investigations into the accounts of Afex Commodities Exchange Limited across 28 banks in Nigeria. This follows the company’s alleged inability to repay a loan of ₦17,808,452,467.107 granted by Guaranty Trust Bank (GTBank).

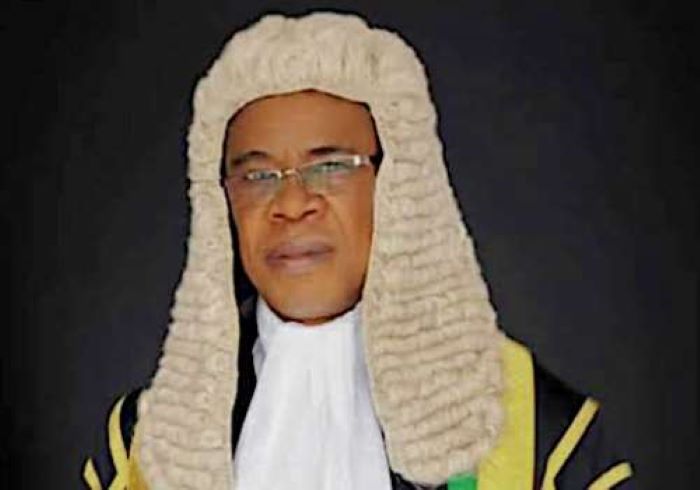

Justice Chukwujekwu Aneke issued the order after granting a Motion Ex-Parte filed by GTBank’s counsel, Chief Ajibola Aribisala (SAN). The court has instructed the CBN and EFCC to investigate whether Afex maintains accounts with these banks and determine if there has been any falsification of financial statements.

The investigation will cover the period from February 27, 2024, to May 27, 2024. Both the CBN and EFCC have 30 days from the date of service to file their reports with the court.

Additionally, the court ordered Stanbic IBTC Bank Plc, Providus Bank Limited, Union Bank Plc, and any other implicated banks, based on the CBN and EFCC’s findings, to transfer funds held in Afex’s accounts to Afex’s designated account at GTBank (account number: 0425755319).

At the most recent hearing, GTBank’s counsel, Chief Aribisala (SAN), requested an adjournment to allow time for the CBN and EFCC to comply with the court’s directive. He argued that 90% of the banks involved have failed to provide truthful and accurate account information.

In response, Afex’s lawyer, Prof. Olawale Olawoyin (SAN), opposed the adjournment, stating that the pending applications, including a Preliminary Objection, should be heard. Olawoyin also urged the court to release certain individuals cited for contempt, arguing that they had no involvement in the case.

Justice Aneke ruled to adjourn the case until September 26, 2024, for the hearing of pending applications.

Earlier, the court had granted GTBank interim control over Afex Commodities Exchange’s assets and accounts due to the company’s failure to repay a Central Bank of Nigeria (CBN) Anchor Borrowers’ loan, which formed part of the alleged ₦17.8 billion debt.

The debt includes ₦15,766,475,417.06 in outstanding principal and accrued interest as of April 17, 2024, along with pre-judgment interest at a rate of 28% per annum, post-judgment interest, and recovery costs totaling ₦2,041,977,050.047.

GTBank, the sole plaintiff, filed the suit (FHC/L/CS/911/2024) against Afex Commodities Exchange, with 27 commercial banks and money deposit banks listed as nominal respondents.

The plaintiff stated that the loan was intended to support smallholder farmers under the CBN Anchor Borrowers’ Program, with repayment to come from the sale of maize produced. However, Afex allegedly failed to meet its obligations, prompting GTBank to seek a Global Standing Instruction (GSI) to recover its funds.

The court granted GTBank’s request and ordered a “No Debit” to be placed on all funds held by Afex in the 28 banks involved.