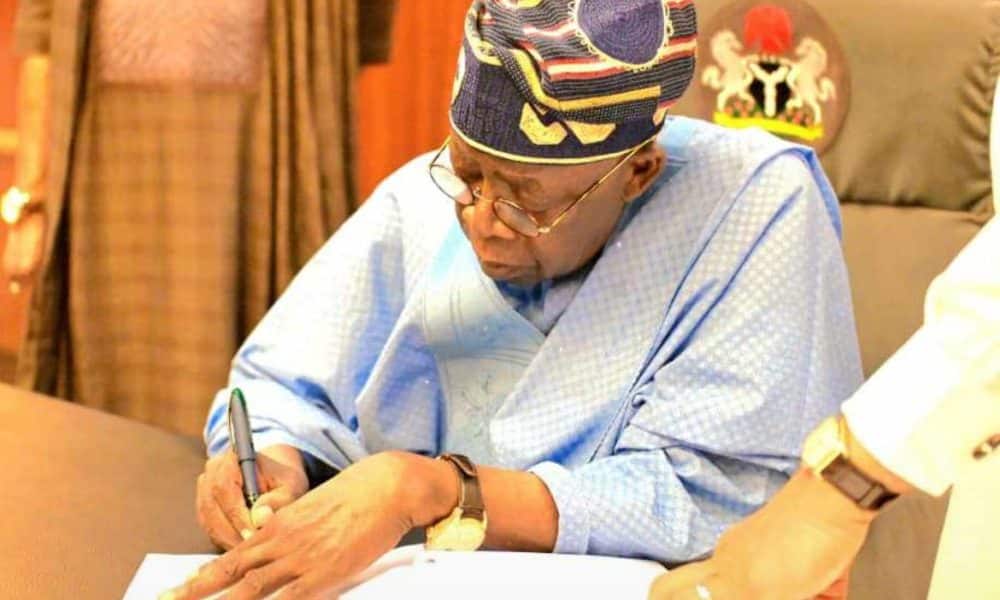

Members of Nigeria’s National Assembly are sharply divided over four tax reform bills recently introduced by President Bola Tinubu’s administration. The bills, which arrived in the Assembly on September 3, 2024, propose sweeping changes to Nigeria’s tax framework, intending to modernize and streamline the system.

These reforms, formulated by the Presidential Committee on Fiscal and Tax Reforms chaired by Taiwo Oyedele, aim to address existing tax challenges and generate more revenue for development.

The four proposed bills include the Nigeria Tax Bill 2024, which seeks a comprehensive approach to taxation; the Tax Administration Bill, aimed at standardizing tax practices; the Nigeria Revenue Service Establishment Bill, which proposes the establishment of a new tax service to replace the Federal Inland Revenue Service; and the Joint Revenue Board Establishment Bill, which includes plans for a tax tribunal and a tax ombudsman.

Central to the debate is the introduction of a derivation-based model for distributing Value Added Tax (VAT), where revenue would be allocated to states based on consumption rather than company location. This shift has generated substantial controversy, particularly among northern governors and lawmakers.

The 19 northern governors, along with traditional leaders, expressed strong opposition to this proposed VAT model, arguing that it does not align with the economic interests of northern states. According to the Northern Governors’ Forum, the model would reduce revenue for less industrialized regions and might threaten the economic stability of northern states.

Adding to the discord, the National Economic Council, chaired by Vice-President Kashim Shettima, advised that the bills be withdrawn to allow for more extensive consultations and consensus building.

Among the legislators, opinions are split. Senator Ali Ndume (APC, Borno South), during a televised interview, denounced the bills, vowing to rally northern lawmakers to resist them. Senator Ogoshi Onawo from Nasarawa South echoed this view, criticizing the reforms as insensitive given Nigeria’s current economic challenges.

“This bill will impose more hardship on Nigerians,” Onawo said, highlighting the strain additional taxes would place on an already struggling populace. He urged President Tinubu to consider the National Economic Council’s recommendations and either withdraw or amend the bills.

Another northern senator, who wished to remain anonymous, assured the public that legislators would uphold fairness in their review process. He emphasized that input from Nigerians would be welcomed in order to reflect their views on the reforms. “We will allow Nigerians to have a say and take part in the process,” he stated.

Conversely, some lawmakers from the South-West view the reforms as a much-needed adjustment to Nigeria’s outdated tax system. House of Representatives member Babajimi Benson (Ikorodu Federal Constituency, Lagos) defended the bills, saying they represent a pragmatic approach to revenue generation and tax management.

According to Benson, the reforms provide exemptions for vulnerable groups, reduce multiple tax burdens, and aim to mobilize and efficiently manage the nation’s revenue. Addressing concerns about the derivation model, he argued that no state would be marginalized. He also noted that a proposed five percent equalization fund from the Federal Government could ensure that states receive comparable or greater revenue than under the current system.

Federal lawmaker Oluwole Oke from Osun State acknowledged the controversies but called them a natural part of the legislative process. He encouraged public participation in the bills’ review, noting that tax laws are designed with societal nuances in mind.

“A bill is like raw gold at the goldsmith’s workshop. The governors are bound to have their opinions, which may be based on well-researched positions,” Oke said, adding that public hearings and committee discussions would provide ample opportunity for feedback.

When approached by Sunday Punch, Oyedele, the chairman of the Presidential Committee on Fiscal and Tax Reforms, affirmed that additional consultations with the public and state governors were ongoing to ensure the reforms reflect a broad consensus.

As the National Assembly reconvenes on November 19 after a week-long recess, discussions on the tax bills are expected to take center stage, with legislators preparing for what could be an intense debate on a reform package that could reshape Nigeria’s fiscal future.